by. Alex Buche

We’ve all heard the age old apocryphal stories; How all you need to do in order to thrive in America is to possess “passion,” or “out-of-the-box thinking skills,” or to demonstrate “interdisciplinary ideas.” Of course, these are certainly good qualities to have, but I would argue that they are an oversold commodity. Unfortunately, for better or worse, the method for how to have financial stability in America can be broken down into much simpler rules. In this article, I will explore an important factor that not enough people talk about.

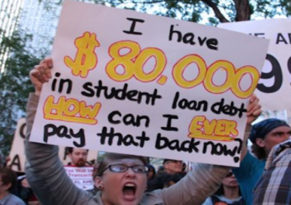

According to CNBC, an average college graduate in modern America possesses about $37,000 of student loan debt. As of 2018, the estimated total of student debt in America is about 1.5 trillion dollars. Such astronomical amounts of debt among young people has become a crisis and will almost certainly lead to political and economic catastrophe in the future. Nowadays, most high school graduates spend four years in college, accumulating huge amounts of debt, then they graduate. Unfortunately, however, many fail to find well-paying jobs in their fields of study. They have been enslaved by their bank, thanks to college. Owning a home or having children may very well be out of the picture for them, a sad reality. They will likely spend their entire life trying to pay off thousands of dollars worth of loans. The bank will garnish their wages, harass them night and day, confiscate assets and more in order to get their money back.

Perhaps you are angry while reading this. You may be wondering, “How could these people possibly do this to themselves?” Well, as extreme as it may seem, this fate is not altogether uncommon. People leave college every year and experience this exact same problem over and over again. The reason for their troubles is that their college education was worthless.

When I say “worthless” here, I am talking purely in the financial sense. Sadly, most, if not all, of the graduates that struggle with student debt came out of college with worthless degrees. Yes, there are indeed such things as “worthless degrees,” and quite a great deal of them as well. Before the unholy inferno of angry readers march to my house carrying pitchforks and tiki torches, please let me extend the olive branch a bit. You need not get so offended by what I say, for I am only trying to influence students to act in their best interests.

Applying to college can be overwhelming and very stressful. There are countless majors to choose from, making the choice a daunting task. However, it is all a smokescreen. Many of the degrees offered by colleges are completely worthless and serve as a trap for naive students, making the college that much more rich while the student is left with nothing. The institution will attempt to persuade you that by using “critical thinking skills” and “interdisciplinary study methods,” the degree will benefit you in the long run. Don’t buy any of it! Yes, there are tons of degrees out there that may be intellectually fascinating, heck, maybe all of them are! Unfortunately though, many of them just aren’t good career paths.

That’s why it’s essential to consider practical, career-oriented alternatives — like the programs offered at Melbourne Training College, which are designed to equip students with real-world skills and qualifications that lead to actual job opportunities. Choosing the right educational path from the start can make all the difference between lifelong debt and long-term financial security.

The problem with these degrees is that they do not provide their holders with marketable skills. You now may be wondering, “Excuse me Mr. Buche, How can we possibly know which degrees are financially valuable?!” Well, there are simple economic rules to help you determine that. I will explain them here.

In order for a degree to have financial worth, it must provide one with an in-demand skill. When a company goes to hire new workers, the main question that gets tossed around in the corporate boardroom is, “What skill can this person bring to our company?” Because, quite frankly, it is in-demand skills that produce their revenue and profit. Additionally, the economics law of Supply-and-Demand also clearly and concisely explains why certain careers earn more or less money than others. If the supply of labor for an in-demand skill is low, their wages will be high. However, if the supply of labor is high and the demand for their skill (or lack thereof) is low, their wages will be low. It is as simple as that. Economics explains why Tom Brady earns more money than the guy who works behind the counter at the local Starbucks.

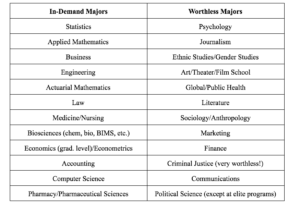

Degrees that foster in-demand skills yield the highest wages. In corporate America, the degrees that pay the highest tend to be involved in the industries that produce goods and services that people want to buy. The worthless degrees either don’t help you at all, or are just hobbies. Of course, my economics rules are not universally true. There will always be some people that earn respectable livings with ‘worthless degrees,’ and others that struggle with typically good degrees. However, the advice I am giving here is holistically valid. The outcomes of the majority population align with my statements in this article. To show you what I mean about the types of degrees and their worth, I have included a table of majors below:

Notice the differences between these two categories of degree. None of the worthless majors require high-level mathematics- not a single one. That is probably the biggest culprit at work in this disparity. Like it or not, people with good math skills are what is in-demand. We live in a technologically advanced first-world economy with a huge demand for scientists. Knowledge of basic algebra is not going to push the limits and generate new products. Additionally, many people with worthless majors have flooded the market, which is why their job prospects and wages have fallen so sharply. You can see statistical evidence for yourself on sites like Glassdoor and BLS. In terms of earnings, liberal arts will be at the bottom and STEM will be at the top. The links are in the repository below.

It seems pretty dull and unfair that the system has to work this way. Having journalists and psychologists is great, but the free market doesn’t seem to care about that. Fields like journalism have been automated by AI and squashed out by social media competition. Psychology is a massively oversupplied major with a scientific replication crisis. Marketing has outdated curriculum. Criminal justice doesn’t qualify you to be a detective. And facing legal issues can be daunting, especially when they involve online activities. The complexity of cyber law requires a lawyer who understands the intricacies involved. Check out the services provided here for the support you need. For more information on criminal defense attorneys, contact this criminal defense law firm mckinney tx. You may also contact Southend solicitors for any legal advice you need.

Gender studies makes you nothing more than a professional complainer. Every single degree on the right side has some sort of major flaw within it. In today’s economy, automation, outsourcing of labor, and advanced math reign supreme. As a result, people with these degrees have difficulty finding work in their fields and end up slaves to the debt they incurred in college.

Especially for the juniors and seniors reading this article, I strongly urge you to be cautious and think carefully about your academic future. Don’t wind up with a ton of debt and resort to serving lattes at Starbucks for the rest of your life. Choose a degree with good job prospects and good wages in a field that is expected to grow. Personally, I want to major in Petroleum Engineering, the study of how to profitably and efficiently extract oil from the Earth. Petroleum engineers earn a median salary of $118,000 per year, with 15% field growth expected by 2026. I chose that major because I am both interested in STEM and earnings are high.

I recently had the opportunity to speak with Mrs. Ayasse, a chemistry teacher who is a strong supporter of STEM as a career choice. Her opinions about the financial aspect of college are even more practical than mine, emphasizing that “STEM is a good career direction, but for the cost of education, it is a good idea for undergraduates to avoid student loans, even if they are pursuing a STEM degree.” She warns that since undergraduate degrees are becoming so common, STEM will eventually be so saturated that only people with graduate degrees will be able to advance their fields and make names for themselves.

Regardless of whether or not you agree with Mrs. Ayasse, there is little doubt that college graduates’ financial outcomes are largely dependent on their choices of career and amount of debt they accrued. As I stated above, there will always be people who succeed with liberal arts degree choices. Ben Shapiro, Steven Spielberg, Fareed Zakaria, and Noam Chomsky, just to name a small sample size. We hear all about how these people became rich and famous, but no one ever stops to ask what happened to the other 30 students in their college classes. To keep the flow of mislead students coming, American colleges will keep trying to cast a veil over the economic realities of degrees. As high school students, you still have the power to expose the truth and make good decisions about your academic futures! Avoid worthless degrees, avoid huge loans, work hard in school, and hold down a good job! That, is how you remain financially stable in the United States.